Introduction

When it comes to securing your financial future post-retirement, choosing the right pension scheme is crucial. With several options available, understanding the nuances of each can make all the difference. In India, the Unified Pension Scheme (UPS), National Pension System (NPS), and the Old Pension Scheme (OPS) are three popular options, each offering unique benefits and structures. But how do you decide which one is right for you? In this article, we’ll dive deep into a comparison of these three schemes, exploring their features, benefits, and suitability for different individuals.

Table of Contents

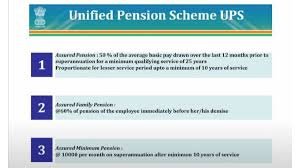

What is the Unified Pension Scheme (UPS)?

The Unified Pension Scheme (UPS) is a government-initiated retirement plan aimed at providing a steady income to individuals after retirement. It was introduced as part of a broader effort to streamline pension systems in India, ensuring a more uniform and manageable structure.

Key Features of Unified Pension Scheme

- Centralized Management: Managed by a central authority to ensure consistency and reliability across different regions.

- Defined Contribution Plan: Both employees and employers contribute to the scheme, which is then invested to grow the pension fund.

- Portability: Employees can carry their pension benefits when they switch jobs, making it ideal for individuals with a dynamic career.

Benefits and Drawbacks of Unified Pension Scheme

Benefits:

- Simplified and uniform structure across the country.

- Portability of benefits enhances flexibility for employees.

- Offers a balanced mix of security and growth potential.

Drawbacks:

- As a relatively new scheme, its long-term sustainability and returns are yet to be fully tested.

- It may not offer the same level of guaranteed benefits as older schemes like OPS.

What is the National Pension System (NPS)?

The National Pension System (NPS) is another government-sponsored pension scheme designed to promote financial security during retirement. Introduced in 2004, it was initially aimed at government employees but later extended to all citizens.

If you want government Job notification Click here

Key Features of NPS

- Voluntary Participation: Open to all citizens, with flexible contribution amounts.

- Investment Options: Offers a choice of investment funds, including equity, corporate bonds, and government securities, allowing individuals to tailor their risk and returns.

- Annuity Purchase: A portion of the accumulated corpus must be used to purchase an annuity, ensuring a steady income post-retirement.

Benefits and Drawbacks of NPS

Benefits:

- Flexibility in contributions and investment choices.

- Potential for higher returns due to equity exposure.

- Significant tax benefits under Section 80C and Section 80CCD(1B).

Drawbacks:

- Returns are market-linked, so there is no guaranteed pension amount.

- Mandatory annuity purchase may reduce the liquidity of the retirement corpus.

What is the Old Pension Scheme (OPS)?

The Old Pension Scheme (OPS) was the standard retirement plan for government employees before the introduction of the NPS. It operated on a defined benefit model, where the pension amount was predetermined based on the employee’s salary and years of service.

Key Features of OPS

- Defined Benefit Plan: Guaranteed pension amount based on last drawn salary and length of service.

- Government Funding: Entirely funded by the government, ensuring a steady and predictable pension income.

- Non-contributory: Employees were not required to contribute to the scheme, making it highly attractive.

Benefits and Drawbacks of OPS

Benefits:

- Guaranteed pension provides financial security and predictability.

- No risk of market fluctuations affecting pension amounts.

- Particularly beneficial for long-term government employees.

Drawbacks:

- High cost to the government, leading to its eventual phase-out.

- Lack of portability and flexibility, making it less suitable for today’s dynamic workforce.

Comparison of Unified Pension Scheme, NPS, and OPS

Contribution Structure

- UPS: Both employee and employer contributions.

- NPS: Primarily employee contributions, with an optional employer contribution.

- OPS: No contributions from employees; fully funded by the government.

Tax Benefits

- UPS: Offers tax deductions under Section 80C.

- NPS: Additional tax benefits under Section 80C and Section 80CCD(1B).

- OPS: Limited tax benefits compared to modern schemes.

Pension Calculation Methods

- UPS: Based on the accumulated corpus and annuity purchased.

- NPS: Market-linked returns with a portion used for annuity purchase.

- OPS: Defined benefit based on last drawn salary and service years.

Risk Factor and Investment Management

- UPS: Moderate risk, managed centrally with diversified investments.

- NPS: Higher risk due to equity exposure, but with potential for higher returns.

- OPS: Low risk, guaranteed returns with no market exposure.

Flexibility and Withdrawals

- UPS: Portability across jobs, with flexible withdrawal options.

- NPS: Partial withdrawals allowed under specific conditions, with annuity purchase mandatory.

- OPS: Limited flexibility, with a fixed pension structure.

Suitability for Different Individuals

Government Employees

- OPS remains ideal for long-serving government employees due to its guaranteed benefits.

- NPS is mandatory for new government recruits, offering flexibility and potential for higher returns.

Private Sector Employees

- NPS is highly suitable due to its flexibility and tax benefits.

- UPS could be a future alternative if adopted more broadly in the private sector.

Self-Employed Individuals

- NPS stands out as the best option due to its voluntary nature and flexibility in contributions.

Tax Implications of Each Scheme

Tax Benefits in Unified Pension Scheme

The UPS offers standard tax deductions under Section 80C, making it comparable to other retirement savings schemes.

Tax Benefits in NPS

NPS provides robust tax benefits, including an additional deduction of up to ₹50,000 under Section 80CCD(1B), which is above the ₹1.5 lakh limit under Section 80C.

Tax Benefits in OPS

OPS offers limited tax benefits as it was not designed with tax-saving incentives in mind, focusing more on guaranteed pensions.

Long-Term Financial Security

Retirement Corpus Accumulation

- NPS allows for a potentially larger retirement corpus due to market-linked returns.

- UPS offers a balanced approach, though returns are generally moderate.

- OPS provides a stable but modest retirement income, secured by the government.

Sustainability of Pension Schemes

- NPS is designed to be sustainable with its defined contribution structure.

- UPS has the potential for sustainability if managed well.

- OPS faces challenges due to its financial burden on the government.