What’s Paytm Share Price?

Paytm Share Price, short for” Payment Through Mobile,” is a leading digital payment and fiscal services platform grounded in India. innovated in 2010 by Vijay Shekhar Sharma, Paytm has revolutionized the way people make deals in India. originally starting as a mobile recharge platform, Paytm has expanded its immolations to include bill payments, online shopping, ticket booking, and indeed a digital portmanteau.

Table of Contents

Why is Paytm’s Share Price Important?

Paytm’s share price is of significant interest to investors, fiscal judges, and the general public. It reflects the request’s perception of the company’s fiscal health, growth prospects, and overall performance. Understanding the factors that impact Paytm’s share price can be necessary in making informed investment opinions. if you want shopping Amazon

The History of Paytm

From Humble onsets to Market Leader

Paytm’s trip from a small incipiency to a request leader in digital payments is nothing short of remarkable. In its early days, the company faced stiff competition and dubitation about the viability of digital payments in India. still, through innovative results and a grim focus on stoner experience, Paytm managed to gain traction.

Factors impacting Paytm Share Price

Market Trends Paytm Share Price

The digital payment assiduity in India is passing explosive growth. With a large population decreasingly embracing digital deals, companies like Paytm stand to profit. Positive request trends can drive up Paytm’s share price as investors anticipate advanced profit and gains.

Company Performance

Paytm’s performance in terms of stoner accession, sale volume, and profit growth directly impacts its share price. Investors nearly cover daily reports and crucial performance pointers to assess the company’s fiscal health.

assaying Paytm’s Financials

Revenue Growth

Paytm’s profit growth is a crucial motorist of its share price. A rising profit trend indicates that the company is expanding its stoner base and adding sale volumes. This can lead to advanced valuation by investors.

Online Shopping Offers Join Telegram I Follow WhatsApp

Profitability Metrics

In addition to profit growth, profitability criteria similar as net profit periphery and return on equity play a pivotal part in determining Paytm’s share price. A company that constantly generates gains is generally viewed more positively by investors.

Recent Developments and News

Paytm’s IPO

One of the most significant recent developments for Paytm was its original Public Offering( IPO). This marked a major corner for the company as it transitioned from a intimately held establishment to a intimately traded reality. The IPO had a significant impact on Paytm’s share price, with investors eager to get a piece of the action.

Competitor Landscape

Paytm operates in a competitive geography with rivals like Google Pay and PhonePe. News and developments related to these challengers can also impact Paytm’s share price. Investors keep a close eye on request dynamics and the strategies employed by challengers.

Expert Opinions on Paytm Share Price

Analyst protrusions

fiscal judges regularly give vaticinations and protrusions for Paytm’s share price. These prognostications are grounded on a thorough analysis of the company’s financials, request conditions, and assiduity trends. Investors frequently use these protrusions as a companion for their investment opinions.

Investment Strategies

Endured investors frequently have their own strategies for assaying Paytm’s share price. Some may concentrate on specialized analysis, while others prefer a abecedarian approach. Understanding different investment strategies can be precious for those looking to invest in Paytm shares.

pitfalls and Challenges

Regulatory Environment

The nonsupervisory terrain in India can have a significant impact on Paytm’s operations and Paytm Share Price. Changes in regulations related to digital payments, data sequestration, and fiscal services can pose pitfalls to the company’s business model.

Competition

The digital payment space in India is largely competitive. Paytm faces competition not only from domestic players but also from transnational titans. Assessing the competitive geography is pivotal for understanding the challenges Paytm may encounter in maintaining or growing its share price.

How to Invest in Paytm Shares

Stock Brokers

Investors looking to buy Paytm shares need to work with stockbrokers or trading platforms. Choosing the right broker can impact the ease of investment and the overall cost. probing estimable brokers is essential for a smooth investment process.

Investment Tips

Investing in shares, including Paytm, requires careful consideration and threat operation. Tips on when to buy, hold, or vend Paytm shares can be inestimable for both newcomers and educated investors.

Online Shopping Offers Join Telegram I Follow WhatsApp

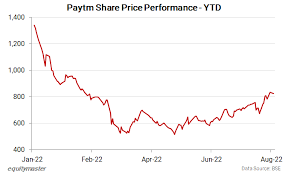

Case Study Paytm Share Price Performance Success Stories

Exploring success stories of investors who served from Paytm’s share price appreciation can give precious perceptivity. These stories can offer alleviation and assignments on effective investment strategies.

exemplary Tales

On the wise side, there are exemplary tales of investors who faced losses due to oscillations in Paytm’s share price. Understanding the pitfalls associated with investing in the stock request is essential to make informed opinions.

Paytm Share Price FAQ

How to Buy Paytm Shares?

Investors can buy Paytm shares through stockbrokers, trading platforms, or online investment apps. It involves creating a trading account, vindicating KYC documents, and placing steal orders.

Is Paytm a Good Investment?

The decision to invest in Paytm shares depends on individual fiscal pretensions, threat forbearance, and request analysis. Consult with fiscal counsels or conduct thorough exploration to make an informed investment decision.

Conclusion

crucial Takeaways Paytm share price is a reflection of its performance, request dynamics, and investor sentiment. Understanding the factors that impact it can help investors make informed opinions. Final studies Investing in the stock request, including Paytm shares, carries pitfalls and prices. It’s essential to stay streamlined on company developments, request trends, and nonsupervisory changes when considering an investment in Paytm.